UK House Price Predictions For 2024 & The Impact On The Construction Industry

As house prices have fallen for six consecutive months and prices have dropped 13.4% from their peak, it’s crucial to understand what UK House Price Predictions for 2024 mean for homeowners, landlords, and the construction industry.

According to the Office For Budget Responsibility, house prices are expected to fall a further 10% in the next year.

An impending general election also brings with it greater uncertainty. If the reduced demand for new housing and renovations continues, what will be the impact on the construction industry?

Let’s take a closer look.

The Trajectory Of The UK Housing Market

With rents at a record high and economists warning of a mortgage “time bomb”, you’re probably wondering about where the housing market is headed. But why is the UK property market in such a fragile position in the first place?

The short (and simple) answer is that it’s due to supply and demand. We aren’t building enough houses to meet the demand. When compared to the average European country, the UK has a backlog of around 4.3 million homes that are missing from the national housing market.

But the shortage has been the case for decades.

So why are things seemingly worse now?

- Climbing interest rates have made mortgages increasingly expensive

- The cost-of-living crisis and rising inflation have hit people’s spending power

- House prices have risen exponentially and wages are lagging.

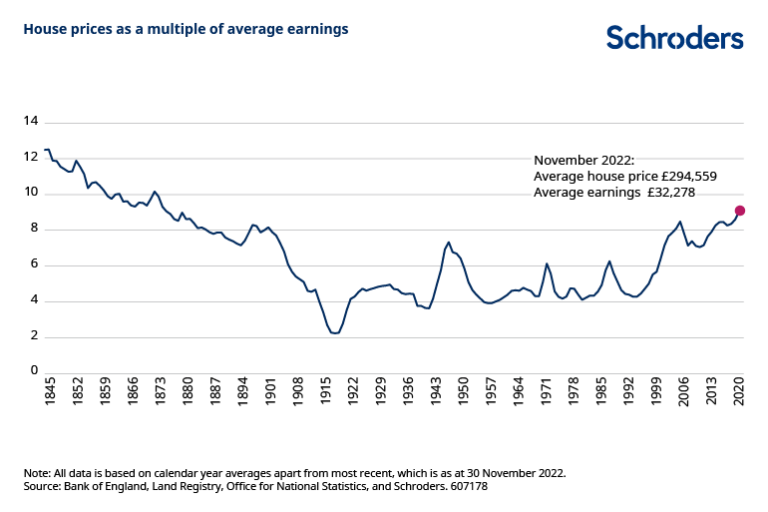

In 1992, the average UK house price was little over four times the average person’s salary, now it’s around nine times the average person’s salary.

Over the last hundred years, aside from the occasional peak, the average price has stayed within the range of four to six times that of the average salary.

Since 1992, that figure has risen, preventing many would-be buyers from getting onto the property ladder and trapping them in rental accommodation.

So, where will the next decade take us?

The answer to that question may hinge on the results of the next general election.

Labour Policy Versus Conservative Policy

Labour pledges

At the Labour Party conference, Sir Keir Starmer promised to build 1.5 million homes during the next five years of parliament. He also pledged to:

- bulldoze through the planning system in England

- build on unused urban land (“grey belt”) to create next generations of new towns

- increase the stamp duty for foreign buyers to disincentivise speculative overseas investment in UK property.

Conservative pledges

Back in 2021, the Conservatives set an ambitious plan to build 300,000 new homes a year, but Michael Gove, the Secretary of State for Housing, has since backtracked, suggesting the initial target was advisory.

In the year prior to the pandemic, there were 243,770 net additional dwellings.

However, at the Conservative Party conference, Gove reaffirmed the government’s commitment to building more homes and said the party is also committed to:

- Easing planning rules in cities to allow the conversion of empty retail premises

- Relaxing rules around barn, warehouse, and agricultural building conversions.

What do the polls show?

The most recent YouGov voting intention poll shows Labour ahead at 43% and the Conservatives attracting just 27% of the vote.

The rest of the votes are distributed as follows:

- Liberal Democrats – 10%

- Reform UK – 8%

- Green Party – 7%

- Others – 5%

While there’s still a while to go, the current sentiment and the results of the recent Conservative by-election losses point towards a change in government at the next general election.

Investment into the housing market will be a key battleground to win over voters, so expect some outlandish headline promises.

The Renters Reform Bill

The Renters Reform Bill is currently under review by Parliament and is set to make the lettings system fairer for 11 million private tenants. If introduced, the Bill mandates the following:

- Periodic assured tenancies, providing more security for tenants

- Landlords must consider and cannot unreasonably refuse pets in their properties

- Landlords can’t refuse to house benefit claimants

- Tenants to give landlords two months’ notice before vacating

The Bill will also see the introduction of a new Private Rented Sector Ombudsman that will provide fair and impartial advice as well as binding resolutions.

But how would the Bill impact the housing market?

Despite making it fairer for tenants, these extra barriers put pressure on landlords in a market that’s already signalling an exodus of landlords.

If landlords and developers don’t supply the housing, who will?

“The government will miss their 300,000-homes-a-year manifesto pledge by a country mile,” according to former Housing Secretary Robert Jenrick.

Love them or hate them, the UK housing market needs private financing.

The Impact On The Construction Industry

We only have to look back at recent history, specifically the credit crunch, to see similar patterns of buying behaviour. The construction industry was one of the hardest hit by the financial crash in 2008, when house values dropped around 20%.

Many homeowners overextended themselves with 100% mortgage values and were left in negative equity.

That meant they were unable to downsize or get a better deal.

Today, around 400,000 people will see their fixed-rate mortgages end over the next few months, and they’ll be remortgaging on an average rate of 6.15% (for a two-year fixed-rate mortgage).

In September 2021, the average mortgage rate was 3.59%.

Depending on a homeowner’s loan to value, and the amount borrowed, repayments may be double or triple than what they were previously.

With mortgage repayments high and house prices declining, there is a very real danger of a “cost of ownership crisis”.

Over 50,000 people have already fallen into negative equity over the last twelve months.

A Bleak Forecast For 2024?

According to the Construction Products Association (CPA), the construction industry is virtually on the brink of a recession due to a (predicted) 7% decline in new-build housing and repair, maintenance and improvement (RMI).

Other forecasts for 2024 are more bullish. A Glenigan forecast predicts a bounce back of 12% at the start of 2024 due to a strengthening in project-starts and a pickup in housing spend.

Sceptics argue that the recovery will be postponed until rising mortgage rates cool and house prices stabilise – not to mention inflation.

There is hesitancy in the market, with many buyers adopting a wait-and-see approach, holding out for lower house prices and mortgage rates.

UK Property Market Frequently Asked Questions

Here are a few frequently asked questions regarding the UK housing market.

Are house prices dropping?

There is a consensus among economists that high mortgage rates of around 5% will remain standard for at least the next couple of years. Given the high-interest repayments, fewer buyers can afford homes, meaning it’s likely that property prices will fall.

Will there be a housing market crash in 2024?

Although there is some acceptance that house prices are taking a hit and will continue to do so, a decline of around 10% (as predicted by the Office For Budget Responsibility) hardly constitutes a crash, at least not a substantial one. A crash is usually defined as a decline of over 10% in a price index from the 52-week peak.

Will interest rates come down in 2024?

The Bank of England expects the base rate to drop to around 5% by the end of 2023, but some analysts’ market predictions point towards a rate rise to 5.75%. Regardless, Andrew Bailey, the governor of the Bank of England, warns that we should not expect interest rates to drop until we see evidence of inflation slowing. The expectation for 2024 is that interest rates will remain broadly flat.

Final Word On UK House Price Market Predictions

The UK property market and construction industry are intertwined. If the housing market were to crash, the construction industry could suffer a shock that would take years to recover from.

The housing policy of the government, both incumbent and impending, will play a large role in shielding both the housing market and the construction industry.

But lessons should be learned from previous stimulus packages.

Rishi Sunak’s stamp duty cuts during the pandemic to cushion the property market may have seemed like a good idea, but economists now argue the act pushed prices up beyond any tax savings for buyers.

The affordability and supply of housing remains the problem in need of solving. Stimulating demand will only exacerbate house price growth.