The Partnership Overview

We based BuildPartner on the simple principle that we could use recent technological advances to increase information exchange in the industry, in particular with regard to pricing. Therefore we are building a collaborative product which enables users to quickly and accurately create budgets, compare prices, and track the progress of their projects.

The initial version of the product is live. However, there’s a lot more to do, in particular prioritising and testing new releases, managing the data and planning the roadmap. We think that the same technological advances in information exchange which have made this business possible can be used to improve the process of building the business itself.

It is now possible for a wide range of people to collaborate on projects at a low cost. So we are asking users if they would like to join as partners on the project. This group will become owners of the product in principle and practice. They will provide feedback as a user, direction for the business as a team member and resources as an investor.

Information on the process is below. The hope is that this will enable us to build a better product, more efficiently, together.

In Principle

The current corporate structure:

Currently, businesses are owned by team members and investors. As a result, capital and control then tend to consolidate in those groups. This is associated with certain problems. Growth in capital tends to be accompanied by growth in inequality and volatility, a slowdown in innovation and collaboration and blindness to wider social externalities.

However, now is perhaps the right time for a different approach. Recent technological advances enable information to be distributed almost instantly at a dramatically lower cost. The result is an opportunity for more decentralised yet efficient and equitable companies.

The Partnership Model:

The partnership model makes it possible, even the default, for a wide range of customers, team members and suppliers to become shareholders in the business. This is done by making it easy, even the norm, to invest their spare time, resources and connections at any point in the business.

Benefits:

To the partners:

- Passive capital creation resulting in equity growth and long term reward

- A more efficient business which will increase revenue streams and lower costs

- Governance rights on the key strategic decisions enabling greater control

To the business:

- More efficient practices resulting in lower costs and higher revenues

- Lower capital requirements resulting in a more stable, efficient company

- An increasingly innovative and socially-minded business

To society at large:

- More efficient, less volatile, more socially conscious businesses

How it works

The partnership approach involves customers in the development of the business. To that end, we are enabling users to invest their spare time, resources and imagination and repaying them with share capital. Examples of which include:

- Product design and feedback (hourly or daily rates)

- Sales and marketing introductions (commission)

- Governance and management (retainer)

Payment:

Any time spent advising, marketing or governing the business will be valued at a quarterly valuation. These payments, for feedback, commission and advisory time can be invested in the company according to the Partner Scheme terms.

Governance:

As a shareholder you will have rights to business information. However, on top of your codified rights we emphasise the spirit of total transparency and equality. As a shareholder, you will be able to take up the right to information and vote at any point.

Reporting and tracking:

Business reporting will be consistent and transparent. Every quarter, metrics will be sent out, results analysed and valuation tracked.

An example

- Monthly advisory payments paid at a per hour rate - £100

- Commission on an introduction of 10% first year revenue - £2,600

Over 12 months: Net equity - £3,800

Company valuations

The last investment round closed at a valuation of £3.2m in April. Partners can invest at any time at the previous valuation or quarterly benchmark.

Tax relief

Tax relief is available to personal investors. Therefore we recommend that investments are made personally rather than by companies or partnerships due to the tax relief available:

EIS relief offsets 30% of your investment against tax. So £5,000 of invested time would result in a rebate of £1,500. And up to 45% again if there is no return on your investment. So a maximum of £1,925 is at risk.

There is also no capital gains tax on any profit if the shares have been held for three years.

Possible scenarios

With early-stage investments the range of possible outcomes is wide. So investments should only be made out of free time, margin or cash, ideally subject to tax.

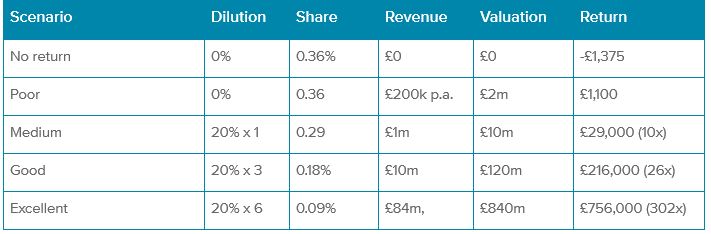

Here are some examples, ranging across, zero, poor, medium, good, and excellent outcomes based on a £5,000 equity stake at a £1.4m valuation:

The level of uncertainty is high but you can help bring it down. That is the point of the scheme. If they work, early-stage tech investments tend to return large multiples. If they don’t, don't expect much back. But tax relief ensures you only lose 25%.

FAQs

In the case that I take the shares, would they be in my name specifically? Do you issue some monthly statements to this effect?

Yes, ideally shares are in your name as that has tax advantages, however companies can own shares as well, the amounts are totalled and valued quarterly.

How do the shares that accrue from advice work with tax? Do I need to 'invoice' you for my time and then you 'pay' via shares such that I can demonstrate to HMRC that I have income which went towards an EIS investment?

Yes, for example we would pay you £100 which you reinvest in the company.

When would be the starting point for my advice accrual? Would we go all the way back to the beginning?

Yes, all time to date is included.

Would you see the time spent on introducing architects as captured by commission or amalgamated into this new advice-for-equity arrangement

Sales time doesn't count as it's commission-based but you can invest the commission at the market value. If the intensity of the sales work increases we can do what's called a 'drawdown' which is paid upfront in advance of the commission.

How do I track how much time has been done

We track the time for you and provide a portal for you to check the progress.

How is the company valued?

Either by external investors or in the interim periods by a valuation committee.

How can I sell my shares?

The natural point is a buyout, but to avoid reliance on that we will cultivate secondary markets to match buyers and sellers.

Do I have any ongoing responsibilities as a shareholder?

Other than filing your tax return when the investment is made, no, there are no other responsibilities. You will have opportunities to vote, and buy or sell shares, which you can take up as you please.

Any questions are more than welcome, we're extremely grateful for your support and very excited about the coming years.

All the very best,