Will UK Construction Costs Fall In 2024?

The big question on many minds is “Will UK construction costs fall in 2024?” The construction sector faces several challenges, such as a decline in housing demand, a stagnating economy due to inflation, and climbing mortgage rates – but what about rising costs?

In this article, we’ll explore how several economic factors are impacting the build cost of UK construction projects and the outlook for 2024.

A Look Back At Historical Construction Prices

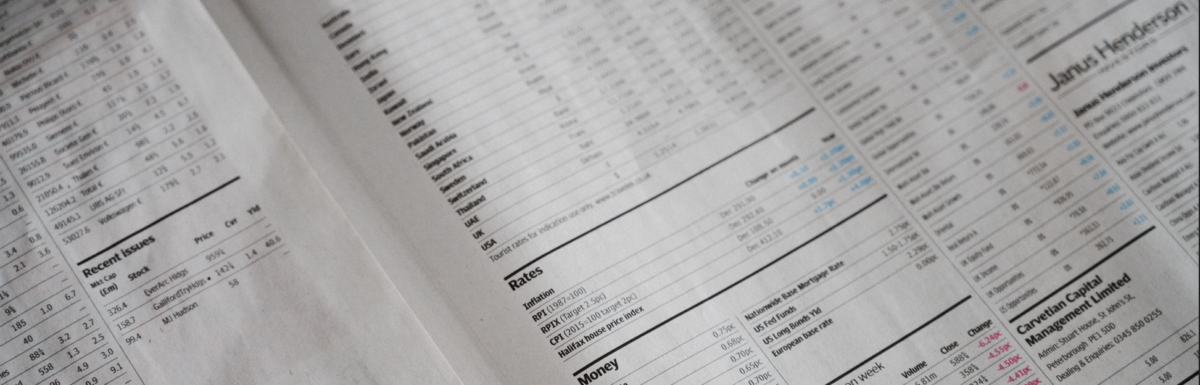

Before we dive into what the market is currently indicating, let’s take a look back at historical prices. The latest figures released by the Department for Business & Trade suggest the construction material price index decreased by 2.1% in October 2023 compared to the same month the previous year.

If you look at the last 24 months in isolation, you see a gradual decline in construction prices. However, this fall is negligible when you consider the increase we saw in 2021/22 – when prices of building materials rose more than 45% at the beginning of the Covid-19 pandemic.

Despite a slight decline from the peak in 2022, material prices have held for the most part – even though the initial demand that triggered the spike has long since subsided. A 2.1% decline in the UK construction price index is a small shift.

Since construction output has fallen by around 7% in 2023, you might be wondering why construction material prices haven’t fallen more drastically. Economics is seldom so formulaic.

There are several factors influencing the prices of construction materials. Here are the ones having the greatest impact in the UK.

1. The Cost-of-Doing Business Crisis

We often hear that we’re in a cost-of-living crisis, but we rarely (if ever) mention that we’re in a cost-of-doing-business crisis.

Inflationary pressure has squeezed the value of the pound, and operating costs are much higher. Rising energy costs, interest rates, wages, and the cost of goods are eroding the profitability of building material suppliers.

Important! UK interest rates now seem to have reached a peak, and it’s expected that they will remain around 5.25% until 2025.

2. The Current Housing Market

Even though the sector has seen a 7% decline in the output of new-build housing as well as repair, maintenance, and improvement (RMI), the forecast for 2024 is more bullish. Glenigan predicts that construction output will grow around 12% at the start of 2024 due to a strengthening in project-starts and a pickup in housing spend.

For prices of building materials to drop, there would need to be a significant reduction in demand for those materials – but so far, construction output remains at relatively stable highs since records began in 2010. Thus, demand for build materials remains relatively high as well.

Even so, as we saw with the pandemic, in April 2020, construction output decreased by 40.1%, but that wasn’t accompanied by a drop in building materials prices – suggesting the construction market is much less reactionary to external economic factors.

3. The Brexit Impact

The cost of labour and materials have increased more steeply in the UK than in the EU, according to The Guardian. Analysis shows that, between 2015 and 2022, the cost of construction materials increased by 60%, whereas they rose only 35% in the EU.

The Guardian hasn’t made it clear which of those EU member states were included in its research, nor have they referenced which building materials this purports to. A more suitable comparison would have been between France and Germany (countries with similar GDP).

Nevertheless, one challenge that is apparent, however, is that before Brexit, 40% of construction workers in the UK came from other EU countries. The end of free movement means there is an even greater shortage of skilled workers, making it harder for companies to recruit and driving up the labour costs of construction projects.

A shortage of labour drives labour costs higher, which increases overall construction costs – subsequently reducing demand.

The Construction Industry Training Board has predicted that the industry will require an extra 225,000 workers to meet demand by 2027.

4. Government Initiatives

The total housing output in 2022 was healthy at £46.2 billion, but it was bolstered by government initiatives (Stamp Duty suspension and the Help to Buy scheme).

The Stamp Duty suspension remains in effect until 31 March 2025. The Help to Buy scheme, however, ended in March 2023. This means it’s now harder for first-time buyers to get a mortgage. They were previously able to secure a mortgage with a 5% deposit.

The dismantling of this support over the last year can be linked with the decline in construction output this year, with experts expecting a further impact in 2025 when the Stamp Duty cuts end.

An impending general election in 2024 could bring with it further stability or instability.

Labour pledges

At the Labour Party conference, Sir Keir Starmer promised to build 1.5 million homes during the next five years of parliament. He also pledged to:

- Bulldoze through the planning system in England

- Build on unused urban land (“grey belt”) to create next generations of new towns

- Increase the stamp duty for foreign buyers to disincentivise speculative overseas investment in UK property.

Conservative pledges

Back in 2021, the Conservatives set an ambitious plan to build 300,000 new homes a year, but in the year prior to the pandemic, there were 243,770 net additional dwellings.

At the Conservative Party conference, Gove reaffirmed the government’s commitment to:

- Building more homes (without offering specifics)

- Easing planning rules in cities to allow the conversion of empty retail premises

- Relaxing rules around barn, warehouse, and agricultural building conversions.

5. A Growing Reliance On Imports

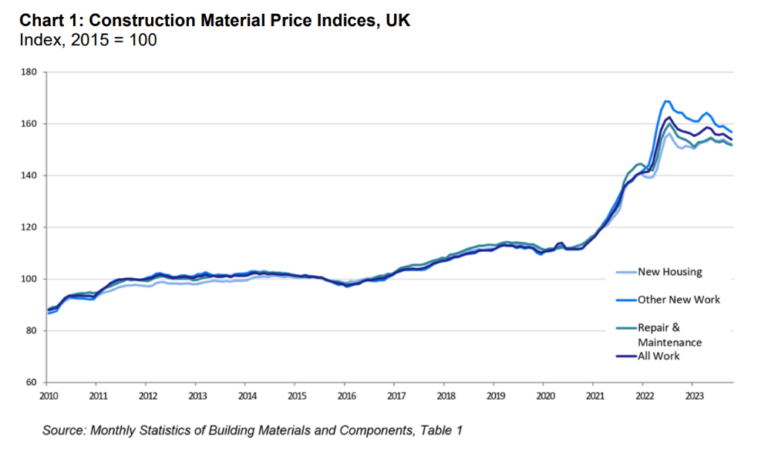

One recent and alarming trend is the growing reliance on imports in the UK. Since Brexit, it’s clear that we do not yet possess the comparative advantages that our European neighbours do, such as Germany and Italy – who accounted for £2.2 and £1.3 billion of imports in 2022, respectively.

The gap between imports has more than doubled since 2015, with UK exports hardly growing in the last eight years. In 2022, the annual trade deficit widened by £3.9 billion to £15.5 billion, an increase of 34.4%. Why? Because foreign suppliers can provide commodities much cheaper than suppliers in the UK.

We imported £1.3 billion of sawn wood in 2022. Given the availability of land and the suitability of our climate for growing trees, it wouldn’t be hard to imagine a future in which the UK was self-reliant in timber production – leaving housebuilders (and their customers) less exposed to volatile prices and less exposed to supply chain disruptions at ports.

The UK also imported £700 million of linoleum products. The UK’s last surviving linoleum factory in Kirkcaldy, Scotland, which opened in 1847, is continuing to produce the eco-friendly and natural flooring solution (made of completely natural materials that come from renewable sources and are 100% biodegradable).

Should the UK be more independent when it comes to sourcing building materials? Self-reliance carries economic benefits as well as ecological benefits, but it’s not high on the agenda of our incumbent government.

What A Drop In Demand Of Brick Sales Tells Us

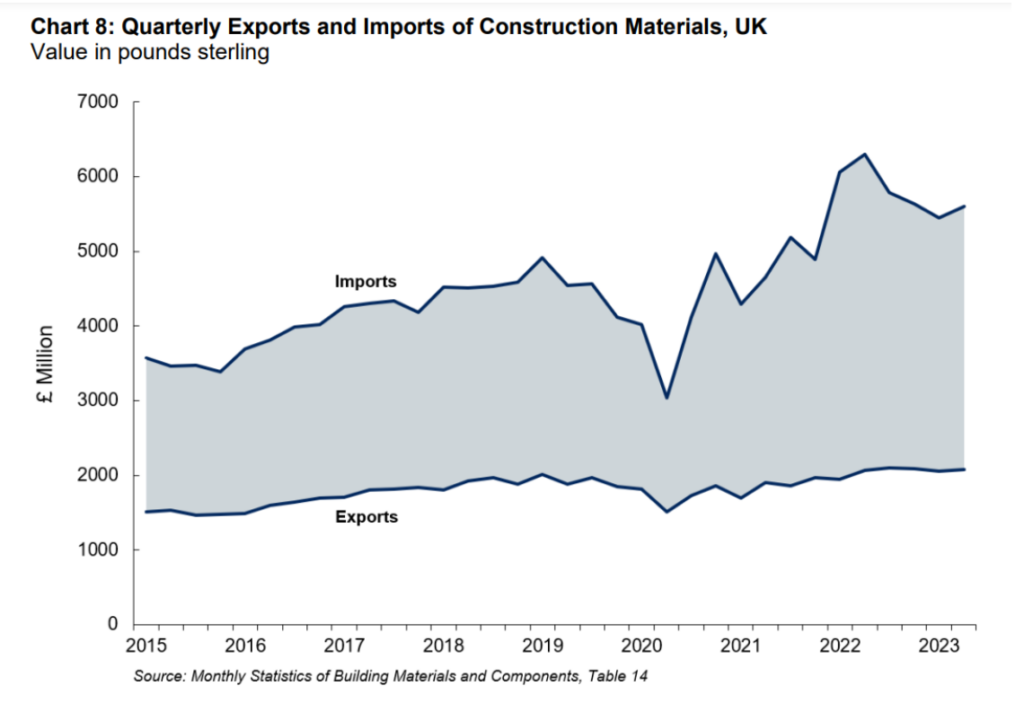

The UK market for brick sales saw a 29.1% decrease in brick deliveries in October 2023 compared to October 2022. It’s a similar pattern for concrete blocks too – a 24.2% decrease year on year. These early signs suggest that the demand for new housing is slowing.

Brick sales have dropped to their lowest level since 2010, and the downward trend looks set to continue. But that doesn’t necessarily mean to say we should expect a price decline.

Why prices rarely come back down

Unless there is something majorly disruptive, such as an innovation that slashes the costs of raw material production, prices of building materials rarely drop back to previous levels following a prolonged increase.

The price elasticity of demand refers to the change in demand when there is a change in the price of a product. Demand is considered inelastic if demand for a good or service remains unchanged even when the price changes.

Necessities such as building materials are inelastic, luxuries are considered elastic.

If demand sustains after a price increase, suppliers have no reason to reduce their prices – because that’s the price that customers are willing to pay. The Invisible Hand of the market determines whether prices will rise or fall.

Final Word On Construction Prices In 2024

Certain markets may see a temporary drop in material costs in 2024 (should we see a decline in construction activity), but due to the several economic factors outlined – government policy, construction cost inflation, Brexit, the annual trade deficit, and the current housing market – most material costs are unlikely to return to previous levels.

The cost of doing business has reached historic highs, meaning suppliers of building materials are faced with a stark choice: charge higher prices or wind up their operations.