UK Construction Building Material Prices & Costs: Official Stats 2024

June 30, 2024

The Department for Business has recently published the latest statistics on construction prices in the UK. In this article, we’ll explore the commentary and statistics, such as construction material price indices, bricks and blocks production, and imports and exports.

We’ll look at this and more, without the jargon, to help you understand the direction the construction industry is heading in and to help you interpret what that could mean for you.

Material Price Indices – Inflation

The material price indices tracks the changes in prices of various construction materials over time, providing a strong indicator of inflation (or deflation) within the construction industry. It comprises pricing data across numerous categories:

- Aggregates – e.g., gravel, sand, and bitumen.

- Cement and concrete – e.g., precast concrete, ready-mixed concrete, and fibre cement.

- Clay products – e.g., bricks, ceramic sanitaryware, and tiles.

- Metal products – e.g., central heating boilers, fabricated steel, and screws.

- Plastic products – e.g., pipes, windows, and floor coverings.

- Timber – e.g., plywood, planed wood, and particle board.

- Other building materials – e.g., plasterboard, paint, and insulation.

Here’s how building material prices have been affected by inflation over the last decade:

No surprises that the last few years have seen volatile inflation. The peak in 2021/22 occurred during the Covid-19 pandemic when there was a sharp rise in demand and supply shortages.

Important! The above graph depicts inflation year on year, not actual price changes. For instance, post-pandemic, the inflation rate slowed, but prices actually continued to rise.

Prices for “All Work” are now in a state of deflation, and have decreased a further 3.1% in April 2024 compared to April 2023, but now seem to have plateaued. Prices for “New Housing” decreased a negligible 0.2% year on year.

Biggest Movers In 12 Months (April 23 – April 24)

As far as actual construction material prices are concerned, here are the biggest movers in a 12-month period from April 23 to April 24:

| Construction materials | % change |

| Pipes and fittings | 19.3 |

| Metal doors and windows | 17.7 |

| Gravel, sand, clays, and kaolin – excl. aggregate levy | 11.3 |

| Gravel, sand, clays, and kaolin – incl. aggregate levy | -12.8 |

| Concrete reinforcing bars (steel) | -18.0 |

| Fabricated structural steel | -22.7 |

Production of Bricks, Blocks, and Concrete

The production of bricks, blocks, and concrete is perhaps the most significant indicator of the demand for construction projects; these figures provide a tangible measure of construction activity in the industry.

| Seasonally adjusted deliveries of bricks | Seasonally adjusted deliveries of concrete blocks |

|

|

| Seasonally adjusted sales of ready-mixed concrete | Seasonally adjusted sales of sand and gravel |

|

|

In all four charts, the trend is broadly the same. Sales (in volume) and deliveries of these building components have reached their lowest point in almost two decades, with the exception of the sharp decline at the outset of the pandemic (in 2020) due to lockdown measures. The last two years are responsible for a further 20–30% decline in output.

What does a decrease in demand mean for prices? If we drill down into the data, we can see that prices for these commodities are actually moving upward:

| Index | 2019 | 2020 | 2021 | 2022 | 2023 |

| Gravel, sand, clays and kaolin | 116.1 | 119.3 | 126.4 | 152.4 | 157.4 |

| Precast concrete: blocks, bricks, tiles and flagstones | 114.3 | 115.8 | 119 | 145.2 | 161.4 |

| Ready-mixed concrete | 103.5 | 101.2 | 107.2 | 126.5 | 147.2 |

| All bricks | [c] | [c] | [c] | [c] | [c] |

[c] represents confidential data.

These commodities are less affected by a reduction in demand because they are necessities, that is, without them, most construction jobs cannot be completed.

Imports and Exports

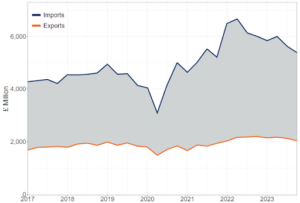

Where are building merchants and suppliers sourcing their products? There is an increasing trend towards importing building materials and components, especially since Brexit, while UK exports to other countries have been stagnant over the last decade.

- Most of the exports are to Ireland (£1.55bn), USA (£1.01bn), Germany (£0.75bn), the Netherlands (£0.65bn), and France (£0.55bn).

- Most of the imports are from China (£4.53bn), Germany (£2.13bn), Italy (£1.31bn), Spain (£1.25bn), and Turkey (£1.06bn).

|

Top 5 exports |

£(million) |

Top 5 imports |

£(million) |

| Electrical wires | 1,023 | Electrical wires | 2,756 |

| Paints and varnishes | 862 | Lamps and fittings | 1,090 |

| Lamps and fittings | 422 | Sawn wood (> 6mm) | 1,024 |

| Air-con equipment | 419 | Air-con equipment | 994 |

| Linoleum flooring | 360 | Ironmongery | 915 |

The annual trade deficit is widening because foreign suppliers can provide commodities much cheaper than UK suppliers. Almost as many building materials are now sourced from China as from Germany, Italy, and Spain combined.

What About Construction Output?

The Bank of England published its most recent update to the Agents’ Summary of Business Conditions in March. While no specific figures were reported, the report suggests that:

- Construction output volumes continue to fall

- House building has fallen markedly over the last year

- Commercial development continues to slow

- Housing associations continue to reduce new builds.

Some figures published by the Office for National Statistics (ONS) support this, suggesting that quarterly construction output saw a decrease of 0.9% in Quarter 1 (Jan to Mar) 2024 compared with Quarter 4 (Oct to Dec) 2023.

As for the overall housing market, the sentiment is slightly more positive among estate agents and economists:

- House prices appear to have bottomed out and are now expected to stay flat or grow modestly over the next few months.

- There are early signs of an improvement in demand, due to more supportive mortgage rates.

In terms of commercial real estate, development is broadly flat year on year and remains very weak, by historical standards. Developers cite the interest rate environment as the reason for this.

What About Construction Wages?

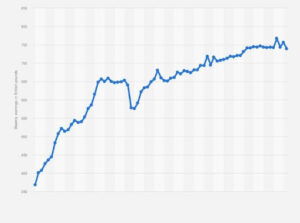

According to Statista, in March 2024, the average weekly wage of construction workers in the UK reached £739, which has been fairly flat for the last four years.

The chart below shows the average weekly earnings in the construction sector in the UK from June 2000 to March 2024.

This rise in wages is symptomatic of the shortage of labour in the construction industry, with vacancies reaching a peak of over 45,000 towards the end of 2023, the highest amount ever recorded.

Summary Of UK Construction Costs

Construction material prices are deflating, but this is likely a temporary adjustment following successive months, if not years, of price increases. In theory, prices dropping means it’s slightly easier for construction firms to lower their costs and pass on the savings to homeowners and developers.

However, the reality is that the current rate of deflation is unlikely to stimulate any real demand in the short term. Only a period of sustained deflation would present an opportunity for a significant shift in consumer behaviour and an increase in output.

Frequently Asked Questions About UK Construction Costs

Here are some frequently asked questions about the building costs in the UK.

How much does it cost to build a 3-bed house in the UK?

Based on the houses we covered in this article, you can expect a 3-bedroom house with a gross internal floor area of 110 square metres to cost around £279,597, or £2,541 per square metre (including labour and building materials). These costs vary by region.

How much does it cost to build an extension in the UK?

Based on the types of extension we covered in this article, you can expect a single-storey rear extension (gross external area of 30 square metres) to cost around £78,186 and a double-storey rear extension (with a gross external area of 60 square metres) to cost around £136,525. These costs vary by region.

How much does it cost to build a bungalow in the UK?

Based on the bungalows we covered in this article, you can expect building a two-bed bungalow (90m2) to cost £174,257, a three-bed bungalow (100m2) to cost £188,284, and a three-bed bungalow with garage and driveway (125m2) to cost £198,801. These costs vary by region.